O2DEX — The Most Innovative DeFi 2.0 Decentralized Trading Platform Is Coming!

O2DEX is the most innovative DeFi 2.0 decentralized trading platform. It is committed to solving the liquidity dilemma that DEX faces in DeFi 1.0. It reduces users’ risk in providing liquidity through a non-constant product market maker mechanism. Along with its deflation mechanism, it can continuously increase the value of trading assets on the platform. O2DEX also has the function of IDO, which can provide more transparent and efficient financing services for projects and help start-up projects to start quickly.

The automatic market maker mechanism of DeFi allows everyone to be a market maker, that is, to become a liquidity provider to obtain benefits from transaction fees. However, this is not a risk-free investment. When the market fluctuates violently, the liquidity providers may suffer more significant losses being a market maker than simply holding tokens.

If the transaction fee income generated by the liquidity pool cannot cover the users’ loss, the users will lose money in providing liquidity. Consequently, users will be less willing to provide funds for the liquidity pool.

Liquidity is the lifeline of a trading platform. The quoted depth will be negatively affected if there is insufficient capital in the capital pool, and the number of users will decline. There will be less transaction fee income if there are not adequate transactions. It will further affect the users’ willingness to enter the liquidity pool. Thus, it will be a vicious circle.

O2DEX is a project designed to solve this dilemma.

What innovations does O2DEX have?

Empowering Liquidity Providers

O2DEX adopts the non-constant product model. It aims to reduce the risks that liquidity providers bear in asset price fluctuations by increasing the value of their assets. It also encourages more users to contribute liquidity to O2DEX and jointly promote the ecological construction of O2DEX.

With the market maker mechanism of O2DEX, the assets sold by users in transactions will not enter the liquidity pool. Instead, 50% of them will be destroyed directly, and the other 50% will be rewarded in proportion to the liquidity providers in the transaction. Therefore, this model helps the liquidity provider reduce the risk of price decline and obtain token rewards other than transaction fees. This is how O2DEX empowers liquidity providers.

When the token price falls, the assets in O2DEX have a stronger resistance to price decline. With the trading mechanism of O2DEX, traders and liquidity providers can have their rights and interests better protected when trading assets with small market value and significant price fluctuation. Traders can trade assets at a better price, while liquidity providers do not have to bear the risk caused by excessive price fluctuation.

DEX with Deflation Mechanism

At present, many projects don’t have the design and value maintenance of in-game tokens. For example, the token economic model is usually set as inflationary overissue to attract more users in the early stage. It will lead to inflation in the later stage of development and seriously suppress the token’s price performance and damage the investors’ interests.

O2DEX has designed a destruction mechanism in the transaction to solve this problem. It ensures that the assets traded on O2DEX will enter an extreme deflation model, which can maintain the value of the traded assets and help overcome the shortcoming of its economic model.

As mentioned above, in O2DEX, the tokens sold in assets trade will not enter the trading pool directly. Instead, 50% of them will be directly sent to the Eater Address for burning, and the other 50% will be rewarded to liquidity providers in proportion. As the volume of token trading increases, the total amount of tokens will continue to decrease. Therefore, the token will become rare, and its value will rise continuously.

The deflation by burning essentially inspires all token holders, and all tokens will have an equal value increase. It is conducive to constructing a token community ecology in which users are more loyal and plays a more significant role in community governance and the project’s long-term development. With the deflation mechanism, the project will gain more support from community users by increasing the value of tokens.

A Fair Token-Issuing Platform

O2DEX is also an issuing platform for project financing from the community. It is committed to building a decentralized, transparent, fair, and efficient financing model, to empower and promote new projects.

The project can accomplish the distribution of tokens through the decentralized way of airdrop on the O2DEX platform and establish an initial liquidity pool on O2DEX to enjoy the one-stop services provided by O2DEX including issuance, pool building, trading, and promotion.

The O2DEX platform allows the projects to raise funds directly from the community. It also provides a series of services from token issuance to liquidity pool establishment to help projects smoothly discover token value. In addition, as a marketing method, airdrop can help projects obtain more attention at the beginning with the popularity and resource of O2DEX. It can help the projects accomplish the cold boot.

For investors, the IDO of O2DEX is an investment channel that allows all investors to participate fairly. It allows early project supporters to obtain more financial returns.

Decentralized Governance

O2DEX adopts DAO’s decentralized autonomous system. DAO acts as a supervisor in O2DEX. For each project that accomplishes token issuance on O2DEX, O2DEX DAO will supervise its whole development process. Every D user can check the project development process through O2DEX DAO.

O2DEX allows all users to participate in a project’s development process to ensure the project progresses steadily through decentralized community governance.

In addition to the above rights, users who hold O2DEX platform tokens also enjoy the right to govern the O2DEX platform. Each holder can participate in the ecological governance of O2DEX and decide the ecological development route of O2DEX by voting.

Richer Community Incentives

In order to fully stimulate the enthusiasm of each O2DEX community user, O2DEX has added diversified incentives to the token economic model, and has written the distribution plan into the smart contract. Users can automatically get rewards as long as they meet the conditions. Meanwhile, the whole process is transparent and open to the public. Each user can confirm the reward distribution process through the block browser.

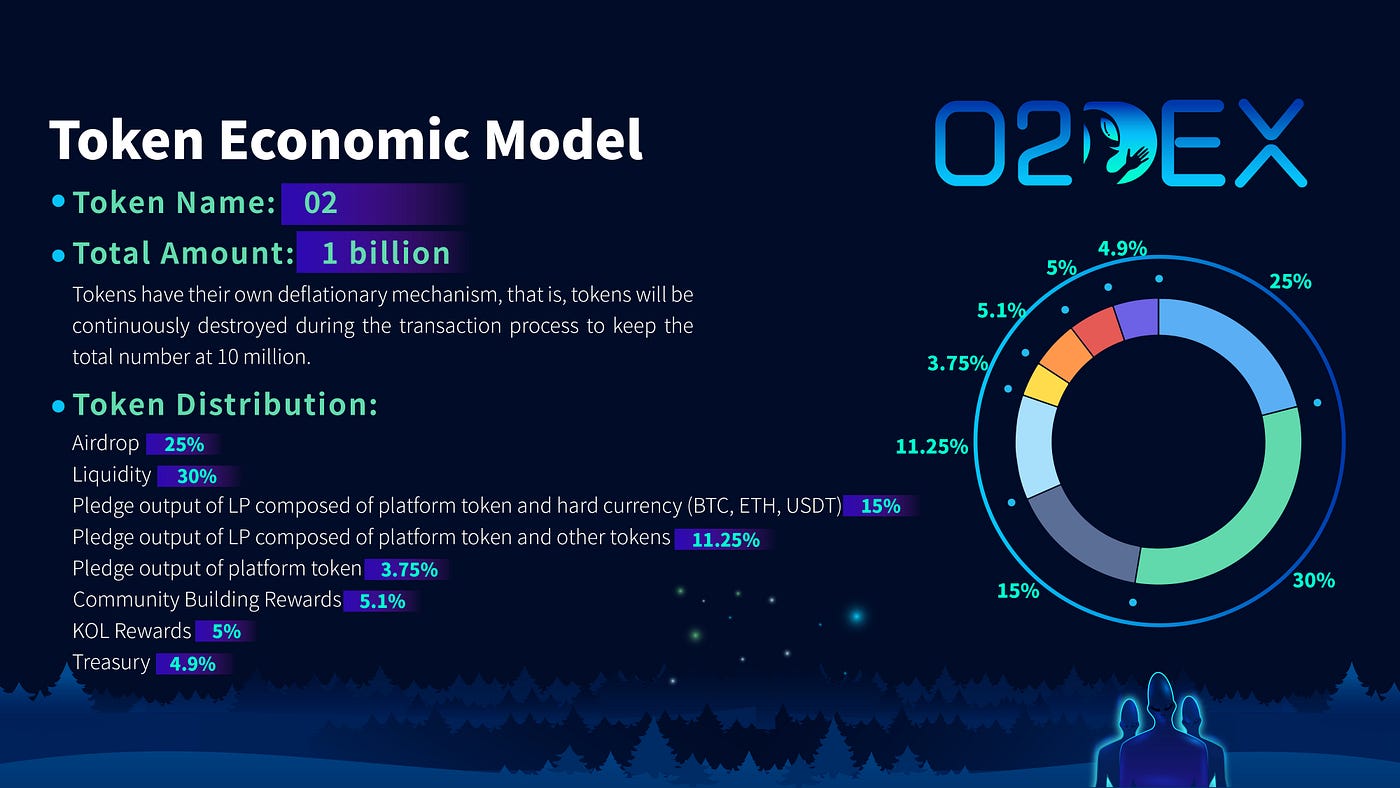

Token Economic Model

The token of O2DEX project platform is O2, with a total amount of 1 billion.

Tokens have their own deflationary mechanism, that is, tokens will be continuously destroyed during the transaction process to keep the total number at 10 million.

Token distribution is as follows:

· Airdrop (25%)

· Liquidity (30%)

· Pledge output of LP composed of platform tokens and hard currency (BTC, ETH, USDT) (15%)

80 million tokens are produced in the first year, 40 million in the second year, 20 million in the third year, and 10 million in the fourth year.

· Pledge output of LP composed of platform tokens and other tokens (11.25%)

60 million tokens are produced in the first year, 30 million in the second year, 15 million in the third year, and 7.5 million in the fourth year.

· Pledge output of platform tokens (3.75%)

20 million tokens are produced in the first year, 10 million in the second year, 5 million in the third year, and 2.5 million in the fourth year.

· Community Building Rewards (5.1%)

Community building rewards last 150 days, 340,000 coins per day. It is used to reward Holder A for airdropping to other addresses. If holder A is the first to airdrop, A can get a reward when the address received the airdrop set up or pledges an LP.

· KOL Rewards (5%)

Divided into 500 copies, each with 100,000 coins. When the KOL builds the community (that is, airdrops to other addresses), and the airdropped address pledges an LP or the market value of the pledged platform currency reaches 100,000 USDT, the KOL receives a reward; if it reaches 200,000 USDT, the KOL receives 2 rewards, and so on. 500 rewards are available until they are exhausted.

· Treasury (4.9%)

The Treasury is controlled by 5 multi-signature addresses, which, in the early stage, are managed by the initiating team. Later, the controller is elected through DAO voting. The Treasury funds will be used for project development, marketing, team salary, etc.

The Team

O2DEX is composed of a group of programmers who have participated in the development of SushiSwap. They have more than 5 years of work experience in the fields of blockchain and cryptography, and hold different ideas for DeFi 2.0. The members have been responsible for various tasks, such as the UI of trading and liquidity mining for SushiSwap, the SushiSwap analysis and statistics website, and the integration of SushiSwap with existing DeFi products. Users are welcome to contact us via O2DEX’s Twitter: https://twitter.com/o2dex

Social Media

Twitter:https://twitter.com/o2_dex

Discord:https://discord.gg/JCKgNHgvVn

Telegram:https://t.me/O2DEX

Medium:https://medium.com/@o2_dex

Reddit:https://www.reddit.com/user/o2dex

Blogspot:https://o2dex.blogspot.com/

评论

发表评论